December 19, 2025

As new home-equity line of credit products emerge across the mortgage landscape for third-party originators, one broker is targeting business lending prospects for bank HELOC offerings.

December 18, 2025

An asset management professional is sought by Saluda Grade, while Splitero Inc. added a sales leader, as did FirstClose, which additionally recruited a new director with deep technology roots.

December 17, 2025

Records are being sought by Sen. Elizabeth Warren (D-Mass.) related to second liens forgiven by major mortgage servicers more than a decade ago, obligations she alleges continue to surface through active collection efforts despite having been formally cancelled.

December 16, 2025

Providers of home-equity lines of credit and closed-end second mortgages traveled to Texas to examine how borrower and employee education, stronger line utilization and expanding securitization options are reshaping strategy. Further origination growth was forecasted for next year.

December 15, 2025

Smaller depositories continued to outpace their larger counterparts last month as they drove another month of expansion in commercial bank portfolios of home-equity lines of credit.

Three upcoming issuances of jumbo residential mortgage-backed securities all contain loans from United Wholesale Mortgage LLC, while affiliates of JPMorgan Chase & Co. play key roles in two of the deals. Subdued coupons on two transactions lack compensating credit risk factors.

Annual issuance of bonds backed by home-equity lines of credit has already doubled last year’s pace as newly closed securitizations showcase rapid paydown loan structures, HELOCs originated through the Figure Lending LLC platform and Achieve Home Loans credit lines carrying note rates that average 1.65 percentage points above prevailing coupons.

Two of three upcoming bond issuances featuring loans that don't meet Qualified Mortgage standards have lower coupons, one lacking compensating credit risk strengths, and a third with higher note rates to offset lower equity.

December 16, 2025

Hometap Equity Partners LLC’s latest securitization of home-equity investment contracts pairs meaningfully stronger borrower credit scores with slightly weaker combined loan-to-value ratios.

December 15, 2025

Nearly $19 billion in issuance of bonds backed by closed-end second mortgages this year include two year-end first-lien deals that feature a few junior liens and a Rocket Mortgage LLC transaction with higher note rates.

December 12, 2025

An upcoming securitization from the J.P. Morgan Mortgage Trust shelf features closed-end junior liens originated across several lenders that carry higher note rates.

December 12, 2025

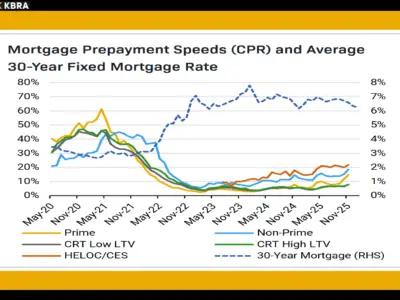

Prepayment activity accelerated across home-equity lending products last month, though momentum proved far stronger among non-prime mortgages, while shifting delinquency dynamics revealed improving early-stage performance for home-equity products and mounting late-stage pressure within non-prime collateral.

December 12, 2025

As the rising cost of owning real estate increases anxiety among homeowners, more of them are seeking home-equity products -- with people younger than 29 seeing the most growth -- and further ascension is expected. Also escalating is the share of super-prime and subprime borrowers. HELOC Demand Bank executives operating...

The HELN Newsletter

July 2, 2025

By COVIANCE Community home-equity lenders have a timely opportunity—but seizing it requires a more strategic approach. Success will come from moving beyond mass marketing, delivering personalized messaging, and simplifying the borrower experience.

November 21, 2025

By MICHAEL MICHELETTI Equity-sharing products make up a rising proportion of home-equity originations, and further expansion appears likely as easier equity extraction, intensifying institutional investor demand, and the appeal of having no monthly payment continue to pull more homeowners toward...