|

|

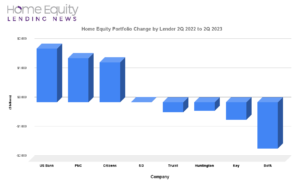

More home-equity assets are on PNC Bank, N.A.’s, balance sheet than any other financial institution. Meanwhile, U.S. Bank, N.A., added more home-equity loans and lines of credit to its investment portfolio than any other depository during the second quarter.

U.S. Bancorp reported that its portfolio of home-equity assets was$12.799 billion as of June 30, growing from one year earlier by $1.826 billion — more than any other financial institution — according to a HELN analysis of bank earnings data.

Next was The PNC Financial Services Group, which reported an increase of $1.507 billion. PNC’s $26.200 billion home-equity portfolio as of mid-year was bigger than at any other bank. It was the second consecutive quarter that PNC held the title, and no challenger is in sight.

Citizens Financial Group’s home-equity portfolio expanded by $1.365 billion to $14.487 billion, while Fifth Third Bancorp reported $0.005 billion in growth, landing its portfolio at $3.911 billion.

Bank of America Corp. reported that its home-equity portfolio closed out the first half at $25.536 billion, declining by $1.584 billion from one year earlier — more than any other lender.

All of the other banks analyzed by HELN — including Truist Bank, Huntington Bancshares and KeyBank — reported a decline in their home-equity holdings.