Saluda Grade is securitizing home-equity lines of credit originated by Figure Lending LLC and its white-label partners, showcasing comparatively low note rates and restrained credit risk.

Recent Headlines

Recent and archived news headlines

🔒CES Loans in Verus Deal, BRAVO Deal Closes

Fresh activity in closed-end second mortgages includes a forthcoming Verus Securitization Trust transaction containing a small set of CES loans and a recently closed BRAVO deal backed entirely by junior liens. Actions were announced for LoanCare LLC’s home-equity servicer ratings.

🔒Point Secures $2.5B Commitment, Originations Triple

Point Digital Finance Inc. has secured a $2.5 billion capital commitment to fund its home-equity investment contract originations, which have tripled this year. On the other side of the transaction is an asset manager with a growing presence in the HEI market.

🔒Home Equity Capital Insider

Capital shifts across the home-equity finance landscape include a $50 million raise aimed at expanding home-equity investment contracts, a blockchain-native stock offering by a leading home-equity line of credit player, and a completed acquisition involving a small home-equity originator.

🔒Chase, PennyMac & Rocket Loans Fill Year-End Jumbo RMBS

More than $2.4 billion in newly identified jumbo mortgage securitizations are tied to loans originated by Rocket Mortgage LLC, PennyMac Corp. and JPMorgan Chase Bank, N.A.

Jumbo WACs Fall Most MoM, HELOCs Have Steepest YoY Drop

Jumbo mortgage securitizations posted the sharpest month-over-month decline in weighted-average coupons among owner-occupied non-conforming deals, while non-QM transactions saw the steepest rise. Open-end real estate loans recorded the largest year-over-year decrease in note rates across tracked products.

Jr Lien Equity Withdrawals Surge to 18-Year High

Quarterly junior-lien home-equity withdrawals climbed 22% from a year earlier, reaching their highest level during any quarter since the Great Financial Crisis and underscoring the renewed strength of second-lien borrowing. Federal Reserve policy moves could drive activity higher.

Credit Unions Expand Junior-Lien Mortgage Portfolios

Home-equity assets expanded across U.S. credit unions during the past four quarters, with institutions adding $24.0 billion in junior-lien mortgages to their balance sheets as demand for second-lien products continued to build.

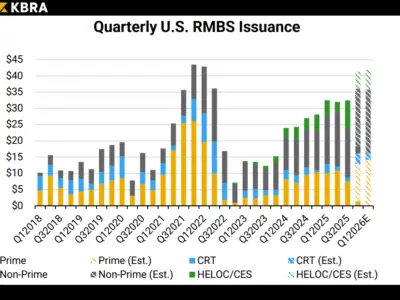

🔒OUTLOOK: RMBS Issuance and Spread Gains Projected for 2026

Expanding activity in home-equity lending securitizations, home-equity investment transactions and deals backed by nonprime and investor mortgages is expected to continue into next year, with spreads likely to strengthen further. Serious delinquency on nonprime pools remains elevated as concern rises over risk layering on loans with alternative income qualification.

🔒Unlock Prepares Record HEI Bond Deal

A forthcoming bond issuance featuring home-equity investment contracts from Unlock Technologies Inc. is poised to become the largest equity-sharing transaction ever tracked by HELN News.